Google Shopping ad clicks surge 18% in Q2 as Amazon, Temu pull back

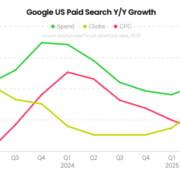

Spending on Google paid search ads rose 11% year over year in Q2, up from 9% in Q1, according to Tinuiti’s latest benchmark report.

- The acceleration comes amid weaker 2024 competition and a significant pullback from key competitors in Google Shopping.

- Click growth rose to 7%, while cost-per-click (CPC) growth eased to 3%.

The standout category was Google Shopping, where clicks surged 18% and spend climbed 19%, a major leap from 9% and 8% in Q1, respectively.

The gains were driven in large part by a sudden retreat of ultra-low-cost retailers Temu and Shein from Google’s shopping auctions in April, following the imposition of steep new U.S. tariffs.

- Amazon also slashed its Shopping ad presence in late May, posting its sharpest two-week impression share drop since March 2020.

Microsoft Search maintained strong momentum, with spending up 17% year over year, flat with Q1. But the bigger shift was in click volume, which rose 15% – a sharp jump from 5% growth the quarter prior.

- CPC growth, meanwhile, plummeted from 11% in Q1 to just 1% in Q2, making Microsoft an increasingly cost-efficient channel for advertisers.

- This growth spanned text and Shopping formats, including Microsoft’s own version of Performance Max-style campaigns, Tinuiti reported.

Performance Max. Google’s Performance Max (PMax) campaigns made a strong comeback in Q2. After slipping in Q1, PMax accounted for 59% of Shopping spend, up from 53%.

- PMax also delivered 59% of Shopping sales, with ROAS just 2% below that of standard Shopping.

- Click-through rates for PMax outperformed standard Shopping by 18%, while conversion rates remained on par.

Outside Shopping, PMax spending on non-shopping search and display inventory hit 28% in June, just below its all-time high. Google-owned properties (excluding Search) drove the majority of these impressions:

- 55% landed on sites like Gmail and Discover.

- 29% on non-Google webpages.

- 11% in mobile apps.

- 5% on YouTube video.

Text ads. Not all segments saw growth. Google text ads struggled, with click volume down 3% year over year and flat from Q1.

CPC growth slowed to 9% (from 13% in Q1), and spend growth came in at 5%. Brand keyword CPCs were still elevated – up 13% year over year – but had cooled from 19% in Q1. Non-brand CPC growth held steady at 3%.

Why we care. Shifts in the competitive landscape (e.g., Amazon, Temu, and Shein pulling back) have created rare openings in Google Shopping auctions, leading to lower CPCs and higher click growth. Performance Max now accounts for 59% of Google Shopping spend, up from 53% last quarter, making it still a dominant force in retail advertising

Additionally, Microsoft’s surge in cost-effective traffic shows it’s becoming a more valuable channel, especially as Google text ads continue to underperform.

Bottom line: Google’s Shopping inventory surged on the back of retailer exits, while Microsoft gained ground with efficient CPCs and higher click volume. Advertisers leaned into PMax as returns held strong across both Shopping and non-Shopping campaigns. With Temu still largely absent and Amazon only recently returning, Q3 could offer more room for smaller players to shine.

The report. Tinuiti Q2 2025 Digital Ads Benchmark Report