Why phrase match is losing ground to broad match in Google Ads

Advertisers have long debated the merits of broad match versus phrase match in Google Ads.

But while arguments around query control and relevancy remain valid, a less discussed but more decisive factor has quietly shifted the landscape: cost.

Recent data shows phrase match is becoming significantly more expensive, often without delivering better results.

Google’s long game: The broad match push

Google has been pushing advertisers toward broad match for a long time through:

- Recommendations.

- Auto-apply features.

- Rep pitches.

- Blog articles – like this one from 2023.

You could convince me that blog post was written in Q3 of 2025.

The pitch hasn’t changed: advances in machine learning, artificial intelligence, large language models, and *insert your preferred buzzword here* have “supercharged” broad match.

More importantly, broad match uses signals unavailable to other match types, such as:

- Landing page content.

- Other keywords in the ad group.

- Previous user searches.

- Location.

Combined with Smart Bidding, this is positioned as delivering better matches and higher ROI.

Dig deeper: What to know about PPC keyword research tools and match types

The real issue: Phrase match is getting more expensive

Advertisers have typically resisted broad match based on two main objections:

- Phrase match already provides sufficient query coverage.

- Broad match inevitably attracts more low-relevance queries.

Both points are valid. A well-built search account with a large keyword set can cover most relevant queries.

Larger keyword lists also allow for more tailored landing pages and ad copy, improving relevancy and quality scores.

And no matter how sophisticated the AI gets, broad match still pulls in low-relevancy queries – I’ve seen enough emojis in search terms to know that for sure.

While I’d love for this argument to hold (because I’m, frankly, a luddite), it overlooks one critical factor: pricing.

Google controls auction pricing through reserve prices, ad rank, and quality score.

So what happens when different match types compete for the same query?

How does Google “reward quality”?

Let’s look at the data.

The CPC gap between match types

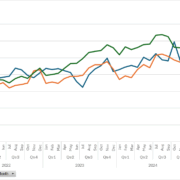

Across my dataset of 7,000+ advertisers’ generic search campaigns, CPCs have climbed steadily over the past five years.

But once Google began actively promoting broad match (a bit before the 2023 blog post), phrase match costs started rising disproportionately faster.

Between June 2023 and June 2025, broad match CPCs rose 29%, while phrase match surged 43%. Advertisers relying on phrase are clearly overpaying for the same queries.

One might argue that exact match is the cheapest, and you could offset costs by building large keyword lists.

But with the release of LSV (low search volume) status, that’s no longer realistic.

This likely isn’t groundbreaking for ecommerce advertisers – broad match adoption there is probably 80–90%.

The real question, given the price dynamics, is whether phrase match should be paused entirely.

Maybe. And it gets worse for phrase match.

Phrase match has also declined in quality.

Close match variants now allow phrase and exact to behave as broadly as broad match, without the AI that helps filter for relevance.

In most accounts, we’re seeing significant increases in close match traffic and corresponding drops in ROAS.

This indicates that pausing phrase match could be beneficial.

The volume currently captured by phrase might have inflated CPCs and lower relevancy than broad match counterparts with 100% query eligibility overlap.

Zooming into one ecommerce account’s generic campaigns, their broad match CPCs were consistently cheaper:

We pivoted to broad-only, as seen in this share of clicks by match type graph:

After the switch, ROAS improved by 13% at similar volume.

While it did increase irrelevant queries and required more negative sculpting, the overall outcome was favorable.

A bonus: this shift also prepares the account for changes to the Google SERP.

As AI Overviews gain traction, broad match will likely be key to winning those placements.

Considerations for lead gen advertisers

The benefits of broad match are clear for ecommerce advertisers, who can feed frequent, high-quality revenue signals to Google’s algorithm.

But for lead gen, relevancy is a much bigger concern.

Even with pricing advantages, many find broad match – and tools like AI Max for Search or PMax – produce too many low-relevance queries.

That’s why Enhanced Conversions for Leads (EC4L) is essential.

It gives the algorithm better quality signals to help broad match identify valuable users, not just anyone who fills out a form or makes a phone call.

Even if you don’t meet Google’s recommended 30 paid customers per 30 days, EC4L can be supplemented with other quality signals, like qualified phone calls tracked via platforms like CallRail.

EC4L lets Google match signed-in users who engage with ads to conversions on your site. Their purchase data is then fed back into the algorithm.

For more complex sales pipelines, you can add intermediary steps to boost signal volume, like this advertiser:

I recently onboarded a lead gen client where we implemented EC4L, switched from phrase to broad match, and enabled value-based bidding. The impact was meaningful.

While cost per conversion rose sharply, those conversions represented actual purchases – not just leads – leading to higher revenue and improved ROAS from generic campaigns.

Dig deeper: 5 ways to improve PPC lead quality

Is it time to pause phrase match?

Many in the Google Ads ecosystem like to joke that keywords will eventually be replaced by themes or some new AI-driven solution.

While that future isn’t here yet, broad match is a clear step in that direction.

One broad match keyword can now do the work of 10 phrase match terms.

Given broad match’s preferential CPCs and phrase match’s rising costs and deteriorating quality, it may be time to accept that phrase is losing ground, for good.